If you have an American Express Platinum card, you can get access to Front of the Line presale tickets. Members receive invitations to the best events before everyone else. Many popular events sell out quickly, so this is an excellent way to guarantee your tickets before the general public does. Another great benefit is purchase protection, which doubles the manufacturer’s warranty for items up to $1,000. This service is available to cardholders in a number of ways.

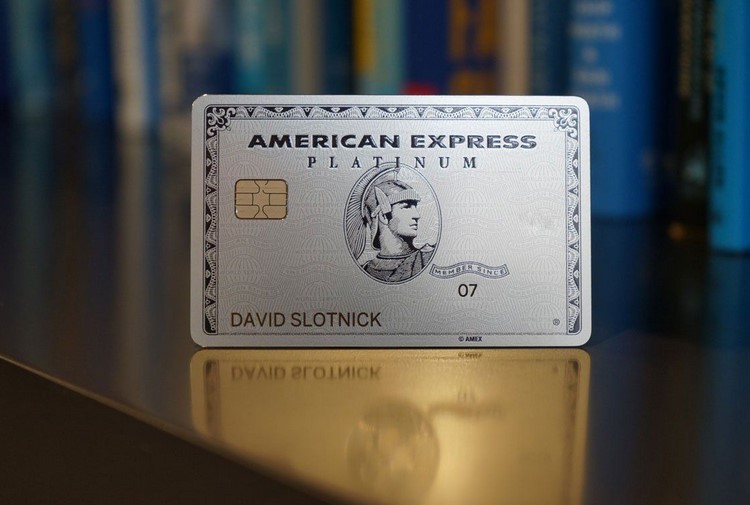

The great thing about American Express is they offer many different credit cards targeted to different audiences. The American Express Platinum card is a charge card and not a credit card. This means that cardholders are encouraged to pay their balance in full each month as opposed to carrying a balance each billing cycle. This gives the Amex Platinum card an edge for those who want points or miles but don’t want to worry about interest charges or paying interest.

Amex Platinum offers extended warranty protection

With the American Express Platinum card, you’ll receive extended warranty protection for eligible purchases. This warranty covers repairs and replacements for your eligible purchases. Unless otherwise noted, the warranty won’t cover items that are secondhand, live animals, or artwork. Learn more about the extended warranty protection benefits of the card in the guide to benefits. This policy also applies to purchases made with the American Express credit or debit card. The extended warranty protection is a valuable benefit to consider when purchasing a new car or other electronic device.

The Amex Platinum card also has travel protection, so you can use it while traveling. In addition to travel protection, the card also covers your purchased warranty for items that have lost or damaged packaging. You can claim this protection up to 90 days after purchase, irrespective of who is responsible for the item’s repair or replacement. Regardless of whether you are the owner or the seller, the extended warranty protection offers peace of mind.

Access to Centurion Lounges

For members of the American Express Platinum Card, access to Centurion Lounges is a prestigious perk. Located throughout the world, these exclusive lounges feature free food and drink, complimentary Wi-Fi, and luxury amenities. In addition to US airports, you can also enjoy access to Centurion Lounges in Hong Kong, London (LHR), and Washington, DC. The largest Centurion Lounge will be located in Atlanta and will feature 26,000 square feet of space.

The lounges are also equipped with Californian cuisine and a wine- tasting room. Each lounge has its own amenities, including a shower suite, open kitchen, family area, and semiprivate workspaces. Amex plans to expand their Seattle Centurion Lounge by the end of 2022, so you’ll soon find a new one. You’ll find them in the Concourse B section, opposite Gate B3, and access them by going through security.

Access to digital entertainment credit

With the American Express Platinum Card, you can now enjoy digital entertainment credit. These credits are available to members of eligible services such as Netflix, Hulu, HBO, and Spotify. You can redeem the credits on eligible merchants. You can also use them to subscribe to subscription services. For example, if you pay for a Premium Plus subscription at Amazon, you can use the credit from your monthly statement to pay for future purchases at the retailer.

As part of the new Platinum Card benefits, American Express has expanded its network of eligible digital subscription services. You can now access Disney+, ESPN+, Hulu, and YouTube TV using your card. Before, you could only use your credit to subscribe to Audible and SiriusXM. Now, you can enjoy the latest movies and TV shows with your American Express Platinum Card. And don’t forget to take advantage of the exclusive Disney+ sale if you subscribe to Disney+.

Travel insurance

The American Express Platinum benefits travel insurance covers you and your immediate family, including spouses, domestic partners, and unmarried children under the age of 19. The plan covers up to $20,000 in expenses if you are unable to fly due to unforeseen circumstances. You can also claim reimbursement for prepaid passenger fares and hotel rooms. There are a few other benefits of American Express travel insurance. You can read about some of them below.

The benefits of American Express travel insurance can help you avoid having to pay a high deductible for a standalone policy. These policies cover the cost of emergency medical care while traveling. Although the benefits of the travel insurance are great, you should remember that the standard travel insurance doesn’t cover Cancel For Any Reason (CFAR). CFAR coverage provides peace of mind and flexibility when canceling a trip. This is why many travelers choose the policy.

The American Express Platinum Card and the perks that it offers are extremely enticing. However, they might not be right for everyone and certainly not without any drawbacks. Still, with the card’s fantastic benefits, I recommend you spend some time exploring what the American Express Platinum Card has to offer and whether it would be a great fit for your wallet.